News and publications

State and Trends of Spatial Finance 2023

Read paper Key Takeaways Technologies for capturing and processing geospatial data continue to improve. Policies and regulations around climate risk disclosures are driving demand for

Report: State and Trends of Spatial Finance 2021

Spatial finance is the integration of geospatial data and analysis into financial theory and practice. This report, published 14 July 2021, is the Spatial Finance

Report: Location, Location, Location: Asset Location Data Sources for Nature-Related Financial Risk Analysis

The availability and state of nature and biodiversity, as well as the quality of ecosystem services, are inherently location specific. Financial institutions looking to assess nature-related financial

Paper: Spatial finance: practical and theoretical contributions to financial analysis

An article introducing and defining the concept of ‘spatial finance’ – the integration of geospatial data and analysis into financial theory and practice – by Ben

Paper: Location, location, location: asset location data sources for nature-related financial risk analysis (2025)

1. Nature, the services it provides and the threats it is exposed to are inherently location-specific. Therefore, financial institutions will need to apply geospatial analysis

Launch of the First Annual Spatial Finance State & Trends Report

Launch of the first annual Spatial Finance State & Trends report 15 July 2021, 15:00 | Online The first annual Spatial Finance State & Trends

How Asset Level Data Can Improve The Assessment Of Environmental Risk In Credit Analysis

The 21st Century will be increasingly defined by emerging and changing environmental risks and opportunities. Environmental risks are fundamental drivers of company and financial risk

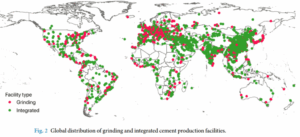

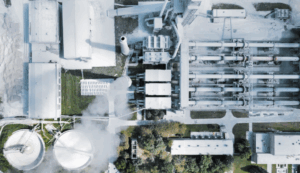

Global database of cement production assets and upstream suppliers – Nature

Read paper Key Takeaways The first globally comprehensive, open source, asset-level dataset of cement production facilities and likely supply sources has been published by the Spatial Finance Initiative.

Establishing the world’s best framework for climate-related and sustainability-related financial disclosures

City of London Green Finance Initiative Working Group on Data, Disclosure and Risk The introduction of a comprehensive and world-leading UK climate-related and sustainability-related financial

Climate Risk Analysis from Space

Remote sensing, machine learning, and the future of measuring climate-related risk Accurate asset-level data can dramatically enhance the ability of investors, regulators, governments, and civil

Breaking the ESG rating divergence: An open geospatial framework for environmental scores

Read paper Key Takeaways This geospatial framework is the first for corporates and investors to assess the environmental impacts of a study area, and uses

Asset-level Data Annual Meeting 2020 Report

On 8th June 2020, the GeoAsset Project at the University of Oxford, as part of the Spatial Finance Initiative, partnered with 2° Investing Initiative to

A global inventory of photovoltaic solar energy generating units

An important new asset-level study focused on identifying solar PV assets globally using earth observation and machine learning by Lucas Kruitwagen, co-founder at Oxford Earth Observation, has been

A Field-Level Asset Mapping Dataset for England’s Agricultural Sector

The agricultural sector is a major contributor to greenhouse gas emissions, yet the lack of asset-level farm data, including ownership, land use, and production, hinders