How Asset Level Data Can Improve The Assessment Of Environmental Risk In Credit Analysis

The 21st Century will be increasingly defined by emerging and changing environmental risks and opportunities. Environmental risks are fundamental drivers of company and financial risk exposure for debt issuers. Asset level data build on disclosure regimes by providing physical and nonphysical asset level information tied to company ownership. The potential of asset level data to […]

Establishing the world’s best framework for climate-related and sustainability-related financial disclosures

City of London Green Finance Initiative Working Group on Data, Disclosure and Risk The introduction of a comprehensive and world-leading UK climate-related and sustainability-related financial disclosure framework is a key priority for both the UK Green Finance Taskforce (GFT) and the City of London Green Finance Initiative (GFI). This report, produced jointly by the GFT […]

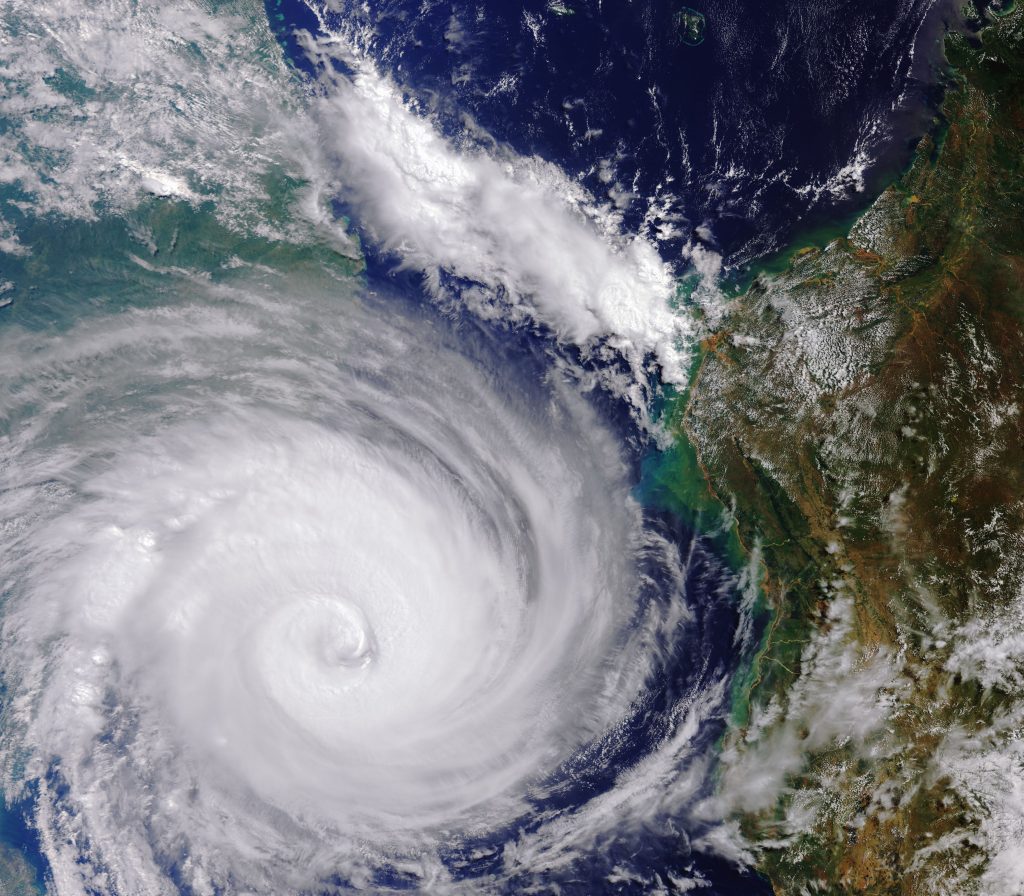

Climate Risk Analysis from Space

Remote sensing, machine learning, and the future of measuring climate-related risk Accurate asset-level data can dramatically enhance the ability of investors, regulators, governments, and civil society to measure and manage different forms of environmental risk, opportunity, and impact. Asset-level data is information about physical and non-physical assets tied to company ownership information. Asset-level data resides […]

VIDEO: Sam Adlen – Can satellite earth observation help to save the planet?

Asset-level Data Annual Meeting 2020 Report

On 8th June 2020, the GeoAsset Project at the University of Oxford, as part of the Spatial Finance Initiative, partnered with 2° Investing Initiative to host a virtual meeting on asset-level data. Financial decision-makers face an unprecedented combination of social and environmental risks, and associated opportunities. Understanding these risks at the required level of granularity […]

Launch of the First Annual Spatial Finance State & Trends Report

Launch of the first annual Spatial Finance State & Trends report 15 July 2021, 15:00 | Online The first annual Spatial Finance State & Trends report delves into the underlying technology advancements and market developments that make spatial finance an increasingly important proposition for financial institutions. It presents both emerging and mature applications that are […]

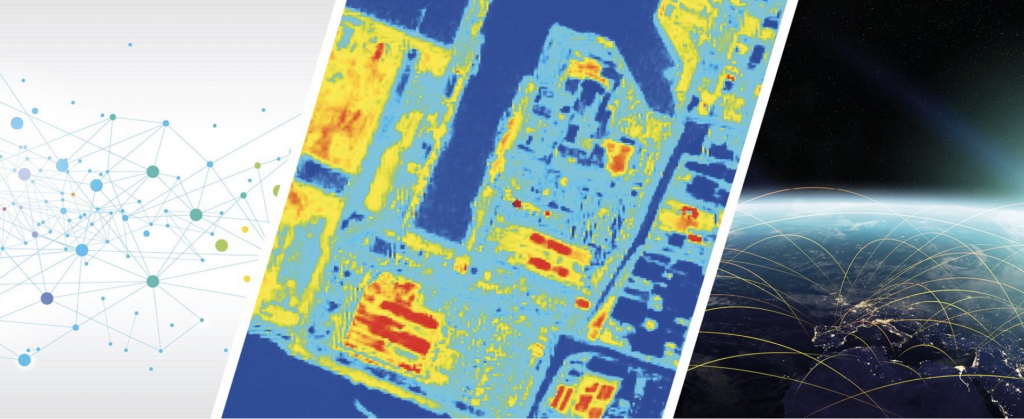

Report: State and Trends of Spatial Finance 2021

Spatial finance is the integration of geospatial data and analysis into financial theory and practice. This report, published 14 July 2021, is the Spatial Finance Initiative’s first annual review of the state and trends in spatial finance. The report examines the underlying technological advancements and market developments that make spatial finance an increasingly important proposition […]

A global inventory of photovoltaic solar energy generating units

An important new asset-level study focused on identifying solar PV assets globally using earth observation and machine learning by Lucas Kruitwagen, co-founder at Oxford Earth Observation, has been published in the journal Nature. Abstract Photovoltaic (PV) solar energy generating capacity has grown by 41 per cent per year since 20091. Energy system projections that mitigate climate change and aid […]

Paper: Spatial finance: practical and theoretical contributions to financial analysis

An article introducing and defining the concept of ‘spatial finance’ – the integration of geospatial data and analysis into financial theory and practice – by Ben Caldecott (CGFI Director) and Christophe Christiaen (CGFI Innovation and Impact Lead) has been published in the Journal of Sustainable Finance Abstract We introduce and define a new concept, ‘Spatial Finance’, as […]

State and Trends of Spatial Finance 2023

Read paper Key Takeaways Technologies for capturing and processing geospatial data continue to improve. Policies and regulations around climate risk disclosures are driving demand for geospatial data and analytics. Solutions for assessing physical climate risks, monitoring outcomes in environmental markets, or understanding nature-related risks and impacts, are some of the fastest growingapplication areas in spatial […]